Do you know what happens to a sales organization when it becomes private equity funded? Or what it takes to optimize the sales organization to create satisfactory results for the new investors?

Sit back and get ready, because we had the pleasure of picking the brains of three sales experts during a LinkedIn Live session, and they covered everything you need to know about sales optimization in private equity funded companies, ranging from sales methodologies and sales enablement to technology.

This is relevant if you’re a sales leader in a company that has received funding, if you’ve been a part of an exit, or if you’d just like to get an update on what’s moving within the private equity space from a sales perspective.

In the following, we’ll touch upon 1) how to accelerate sales growth by leveraging the data in your CRM, 2) why it’s so important to implement a strong sales methodology, and 3) how to drive the change management process while delivering on relevant KPIs. Lot’s to cover, let’s dive in!

Scott Kaplan, Founder and Chief Coach @ Quick Hit Sales Tips

Scott has helped sales teams 2X their bookings with Sales TIPS (Tactics to Improve Professional Sellers), is an international bestselling author, and helps sales leaders and sales reps grow their sales skills and processes by creating a winning sales environment.

James Halle, VP @ Cytel

As a Sales Leader in a PE backed company, James and his team are subject matter experts who cover a range of capabilities from industry leading software, pioneering trial design services and enhanced regulatory approval and patient access through the use of Real Word Data.

Simon Raahave, Account Executive @ Salesforce

Being an Account Executive at Salesforce with a large portfolio of private equity backed clients, Simon has profound insight into what a company needs for when they become private equity backed in terms of data and technology.

Scott Kaplan, Founder and Chief Coach @ Quick Hit Sales Tips

Scott has helped sales teams 2X their bookings with Sales TIPS (Tactics to Improve Professional Sellers), is an international bestselling author, and helps sales leaders and sales reps grow their sales skills and processes by creating a winning sales environment.

James Halle, VP @ Cytel

As a Sales Leader in a PE backed company, James and his team are subject matter experts who cover a range of capabilities from industry leading software, pioneering trial design services and enhanced regulatory approval and patient access through the use of Real Word Data.

Simon Raahave, Account Executive @ Salesforce

Being an Account Executive at Salesforce with a large portfolio of private equity backed clients, Simon has profound insight into what a company needs for when they become private equity backed in terms of data and technology.

Use Technology to Accelerate Growth

Let’s start at the beginning – to be more specific, the beginning of a PE life cycle: the moment when a company becomes funded. As a sales coach, Scott Kaplan is used to working with newly acquired portfolio companies. Thus, it seems evident to open the ball by having him elaborate on the key sales enablement technologies that are necessary to implement in order to create quick wins:

According to Scott, there’s naturally a number of different things you can do when it comes to sales enablement technologies, but what he generally likes to start by doing is contemplating on how to make things scalable and reproducible fast. It could for instance be from marketing to sales, considering how to make the team more effective in their go to market strategies, and the ability to continue to retain and grow customers. Whatever the ambition is, there are great technologies out there to help you on your journey to accelerate growth.

A good place to start, and perhaps one of the most important technologies to have in place, is your CRM system. On top of that, you have the conversational intelligence softwares, which is a great tool for coaching and understanding what could or should be done differently in order to become better. Furthermore, there are technologies that help create more efficiency and effectiveness. For instance, you can implement an outreach style software that provides you with the ability to have different cadences or sequences to do specific types of communication for your SDRs when cold calling. As you can tell, the list of different technologies with different purposes goes on. And the best thing? These outreach or recording softwares are not only for sales – it can also be beneficial for executives or marketing to hear customer sentiment.

It’s All About the Data

Having worked with a number of private equity backed clients, Simon Raahave elaborates on how you can utilize your core CRM to grow your business.

Knowing why, how, and what you’re doing is often key when it comes to your data, so you can make smarter decisions with the correct data. This can enhance customer satisfaction, and hopefully also increase sales in the future; sometimes you just have to double tap a bit more on the data, and know why you succeed or not, based on the data you have in your CRM.

Simon furthermore advises to use data to give a validated explanation to the PE fund on why you expect to be succeeding or not. In other words, you should really be using your data as an opportunity for yourself to coach your sales representatives, instead of just looking into the numbers and forecasting. This way you can optimize your own sales process by using all the data that you have collected around your customer and how you’re using your opportunities. Thus, you know exactly what to chase instead of chasing the wrong opportunities with the wrong customers. As Simon emphasizes: this can enhance your efficiency and give you a higher close rate.

A Successful Exit

So, once you have core CRM and data in place, what is the next step to make sure that your sales organization has the right tech setup in order to increase the value towards an exit?

James Halle has worked in companies at both early and late stages of the PE lifecycle, and he believes it’s all about the data. From a sales leader’s perspective, he says, there are two fundamental reasons to put in technology: one is, it makes the sales team’s life easier when it gets adopted, but then the second is, the data and what you can do with it. Understanding what’s going on in your opportunities and at the deal level is an important first step. But, as it starts to build, and as you get that level of understanding, it’s necessary to try to take on that macro level view of some of the key KPI’s. James uses churn rates as an example; how many customers are you bringing on board at the macro level versus how many are you losing? These key performance indicators are what gives you the bigger overview, and thus the ability to project forward. It also informs you on the areas where you need to make strategic investments. Use it to demonstrate by doing the analysis to show you’re not very strong in this market versus that market – then you can justify an increased headcount and the investments needed. As James argues: 90 out of 99 PE backed companies are all about the growth, and growth comes with data and justification as to why you want to spend money in certain areas, because you’ll get a return on investment.

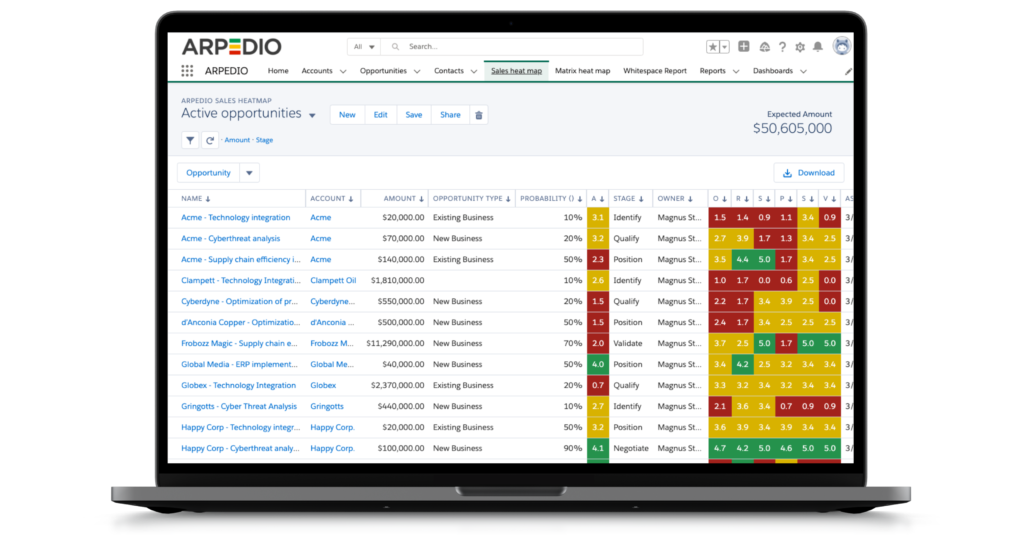

Ready to start taking advantage of sales enablement technologies like account-based selling? Ramp up with ARPEDIO’s account-based selling platform.

The Importance of a Strong Sales Methodology

Once you have your technology setup in place, what else is important for a PE Fund when they make a new investment? Scott, who works with PE backed companies and has previously worked with sales optimization full time at a PE fund, attaches a few words to the subject. Personally, Scott always makes sure he understands exactly where people come from so he can focus not only on the sales methodology, but on the process as a whole: if you want to implement a sales methodology in order to become more effective, you need to ask yourself: how do we actually drive it when we talk about things like scalable and reproducible?

You already have the data to help you determine the starting point. Now you need to build those things in by using a sales playbook, Scott says – this way it’s easy to make sure that you have your sales process and your sales methodology in place. The sales playbook should incorporate not just how to leverage your tools, but also the sales best practices, so for every stage you get concrete action points. You should consider: what are some of the tools or resources that are the best practices, the right emails, the right salesmanship? Then you have to build into that, because it’s all about the key actions and how to effectively do exactly that.

Scott furthermore adds that it’s extremely important to make sure that it’s not only a sales thing, but a company thing. Meaning, if you have a client, it’s not just about helping him – you have to make sure that he actually knows how to implement e.g., a sales methodology and truly understands the pain and how to solve the needs. Once you’re able to solve and track those needs and turn them into customer success stories, then you can track new customers, get referrals, or perhaps a customer case study. Either way, you now have a framework that can continue to scale upon itself. That is why it’s so important to bring in a process tool like a sales playbook – because it makes it incredibly effective to use all of your processes, methodologies and sales best practices.

Adoption and Best Practices

Once the company has defined a sales methodology, how do you ensure efficient adoption through technology? According to Simon, it’s hard to say what best practice is when it comes to adoption, as it differs from each company. But having a system where your sales reps feel that they’re getting the information they need, will make it much easier for them to sell, and thus hit their quota. Put differently: if the sales reps see value within the CRM system, they will use it instead of sticking to PowerPoints or the like. And this is what drives successful adoption.

Giving the sales people the autonomy to say ‘all right, I’ve got some new stuff that I can use as a writing principle’, and then taking the time to align people slowly over a period of time is really the way to go about aligning on the same sales methodology, James adds.

It All Comes Down to the Change Management Process

No matter how good the intentions are, sometimes the adoption will still be lacking. So how do you make sure that adoption is smooth and frictionless? For starters, it’s an organizational thing to get the sales organization to use the system so they can adopt it. It’s a prioritization on what to do and what not to do, and to get everybody involved – this includes both the most skeptical ones, but also the ones that are happy and striving for these new chains. According to Simon, it’s crucial to have an open forum and to be able to discuss what’s working well and what’s not working within the system. So, get the organization to play a key role, which hopefully will add a good feeling to a project so everybody is happy – then it will drive even more success moving forward.

When a company suddenly finds themselves in an investment willing situation, and has to balance between new funds to invest and prioritizing the projects to ensure results, Scott finds that PE usually understands that you can’t turn something around in three months. However, he finds that PE works a lot faster than corporate America, because they do expect you to move fast as they have very high expectations since they’re willing to support you. They want to know that this is the right type of investment, so they want to see some kind of plan or measurement to make sure that it can’t go completely sideways. According to Scott, if you’re going to double or triple your sales team, and the PE fund has the money to do that, how do you make sure it’s actually the right thing to do? You need to measure that type of growth and have the right infrastructure. You should at least prioritize the key initiatives, or have some degree of pipeline and fluidity. So, if you know the KPIs and how to measure it, then you should prioritize internally what the right thing for your company is. All in all, what you should do to successfully balance between new funds and ongoing projects is identify where to invest to achieve your key initiatives. It almost sounds simple, but knowing the steps you need to go through in order to prioritize can make sure you hit your objectives.

Key Takeaways

It’s no secret, there are countless technologies out there that can help you grow your business – it’s finding the right technology that’s difficult. Everyone has their own sales methodology and evidently, there is no one-size-fits-all – even within the same company as different business lines require different things. Especially in the context of PE. Because as your company grows, you’ll most likely hire new people, and these people are going to have different backgrounds and experiences.

So make sure you don’t just implement technology for the sake of the technology, but identify the key things you need from a strategic perspective to get the results you want, and make sure your chosen technology is effective in helping you reach those goals. When it comes to change management, the key is to think about the process as a whole. Simple as it may sound, this is what will drive success when moving forward. By using the sales methodology, or the playbook as a guiding principle rather than a set of rules, it can help you leverage and make people come together – or at least have them use the same framework.

A big thank you to our three panelists, Scott Kaplan, James Halle, and Simon Raahave for sharing their knowledge on how to perform sales optimization in PE backed companies in a truly enlightening LinkedIn Live.

#1 Account-Based Selling Platform

Powerful alone. Superior together.

Boost win rates and reduce sales cycles. Enhance forecast accuracy.